Published : 2025-03-20

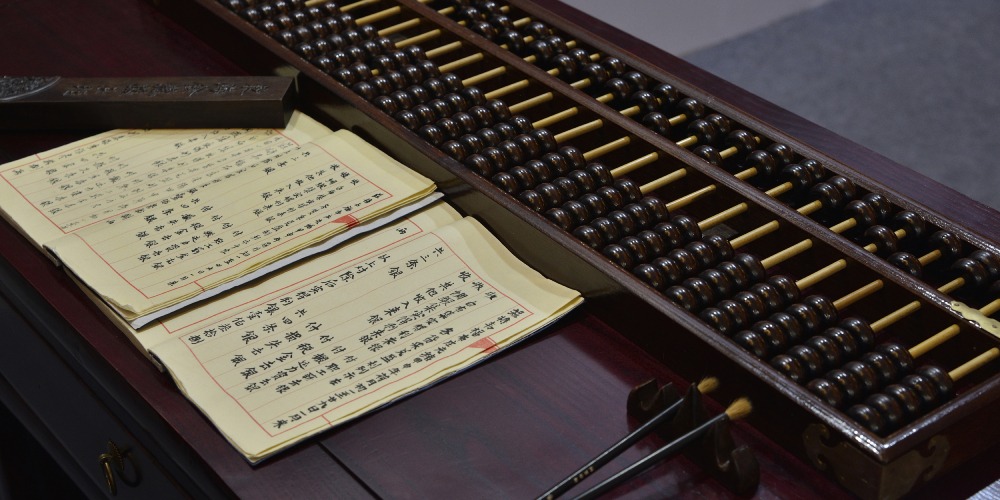

On March 20, 2000, the then Premier of the State Council Zhu Rongji (朱鎔基) issued State Council Order No. 285, promulgating "The Provisions Concerning the Real-Name Personal Savings Account System", which came into effect on April 1, 2000.

The implementation of the real-name system for personal deposit accounts is a major reform in China's savings deposit system.

Although the savings system had been in place for decades in China, financial institutions did not require depositors to provide identification documents or use their real names when opening accounts and handling deposit services. While depositors not using their real names were a minority, it still exposed many drawbacks.

One major issue was that depositors were prone to incurring losses.

According to relevant regulations, if a deposit certificate or passbook was lost or damaged, a depositor needed to report the loss to the financial institution.

However, if the name on the identification document did not match the account name on the deposit certificate or passbook, the financial institution could not process the request.

Moreover, to withdraw term deposits ahead of maturity, the account name on the deposit certificate or passbook must match the name on the depositor's identification document.

Additionally, China has a large population with many people sharing the same name, making it difficult for judicial authorities to determine ownership in disputes involving deposit certificates or passbooks in the absence of a real-name system.

The "Provisions" explicitly state that the real-name system aims to ensure the authenticity of personal deposit accounts and protect the legitimate rights and interests of depositors.

According to the "Provisions", when an individual opens a personal deposit account with a financial institution, they must present their identification document and use their real name. If acting on behalf of another person, both the agent and the principal must present their identification documents.

The financial institution must require the customer to present their identification document for verification and record the name and number on the document. This applies equally to agents acting on behalf of others.

The "Provisions" emphasise that financial institutions must not open personal deposit accounts for anyone who fails to present their identification document or use the name on their identification document.

Any violations will result in a warning from the People's Bank of China and a fine ranging from 1,000 to 5,000 RMB.

Serious violations may lead to an order to suspend operations for rectification, and direct supervisors and other responsible personnel will be disciplined according to the law.

If any actions constitute a crime, criminal responsibility will be pursued according to the law.