Published : 2024-12-29

On December 29, 2005, the Standing Committee of the National People's Congress of China decided to abolish the "Regulations of the People's Republic of China on Agricultural Tax" starting from January 1, 2006.

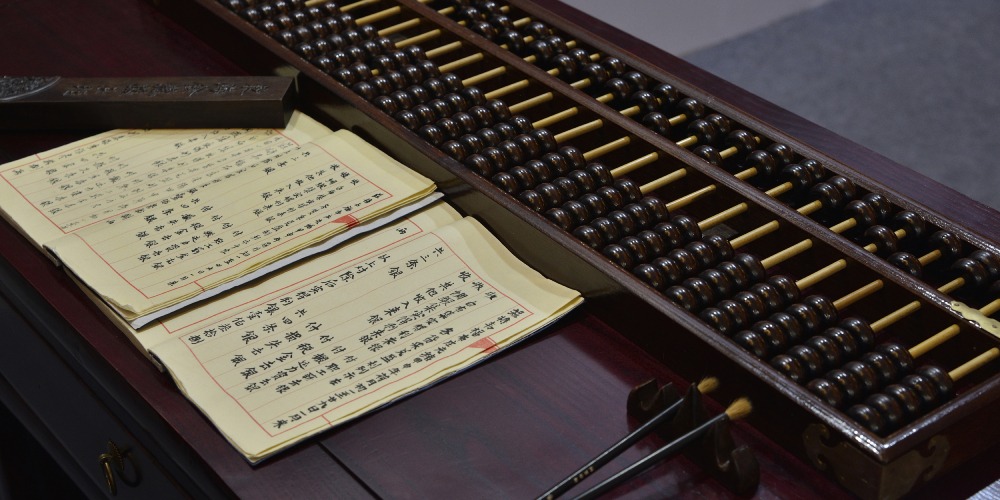

The "Agricultural Tax Regulations" began being implemented in 1958. The agricultural tax that was subsequently enforced actually included the agricultural tax, the agricultural specialty tax, and the pastoral tax.

The "Agricultural Tax Regulations" were implemented for nearly 50 years and were one of the important taxes of the country.

They played a significant role in establishing a complete industrial system and national economic system in China. Farmers, as taxpayers, made great historical contributions to this.

In the late 1970s, after the start of the Reform and Opening-up, the national financial strength continued to grow, and the mechanism of stable fiscal revenue had basically taken shape.

At the beginning of the founding of New China, the agricultural tax accounted for 41% of the national fiscal revenue; but by the beginning of the 21st century, the proportion of the agricultural tax had dropped to less than 1%.

From this point, the agricultural tax, which appeared during the Spring and Autumn Period (770-476 BC) in China and continued for over 2,000 years, has officially become history.

This also marks that China's rural reform has entered a comprehensive stage focusing on the township institutions, rural compulsory education, and county-town fiscal management system reforms.