Published : 2024-03-14

China continues to expand its openness and welcomes foreigners to come to China for exchange, travel, and official duties.

The People's Bank of China (PBOC) has released a guide through its WeChat Official Account in a simple and easy-to-understand way, to inform foreigners about the variety of payment methods they can use after coming to China.

Credit cards, mobile payments and cash all accepted

According to the guide, one of the payment methods is by credit cards. If you have UnionPay, Visa, Mastercard, and other credit cards, you can make card payments at the checkout counter with those logos displayed .

If there is no logo showed, you can consult with the cashier about whether the credit card you hold can be used for card payment.

The guide also states that if you own a UnionPay card, it can be accepted by all merchant POS terminals in Mainland China.

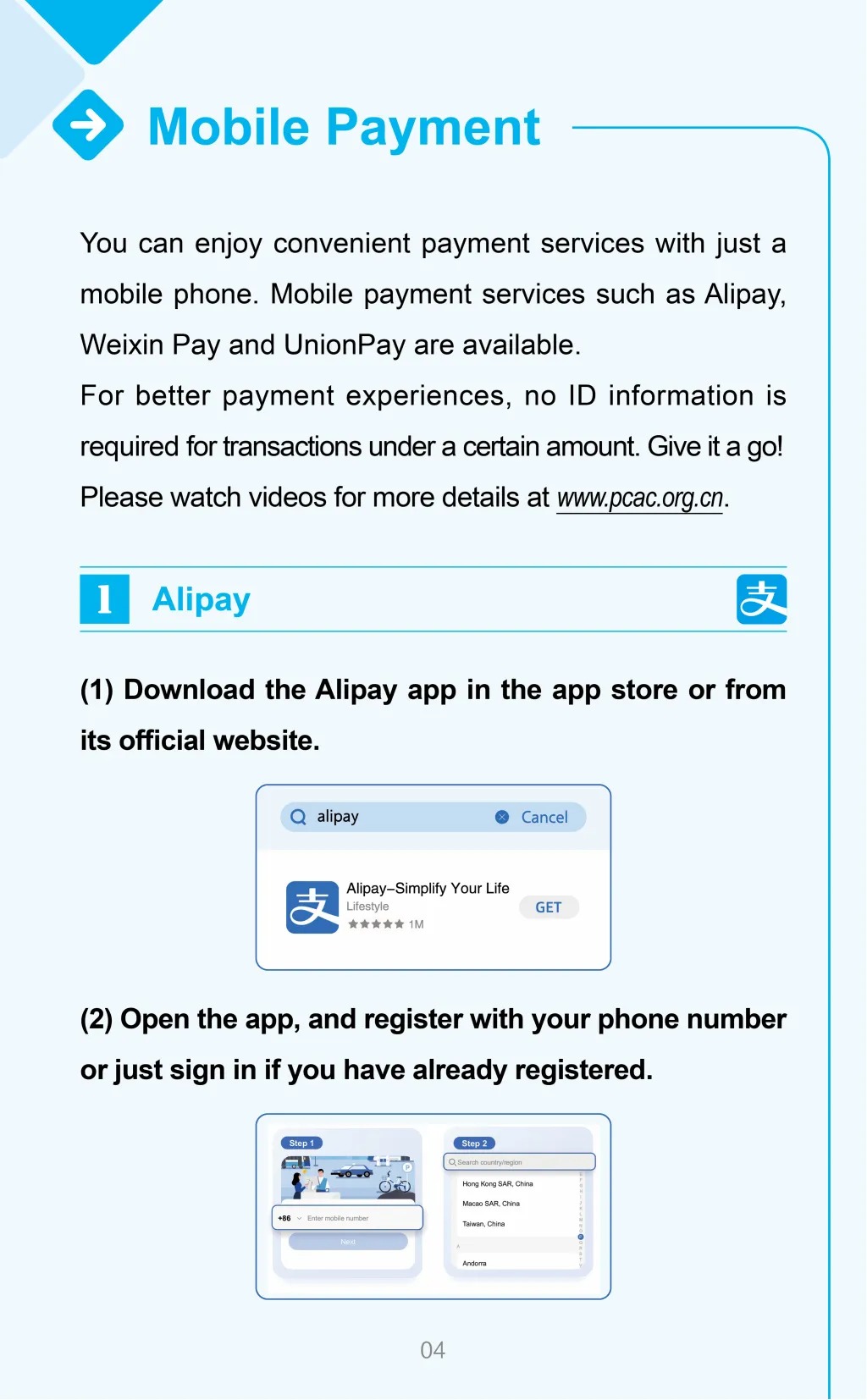

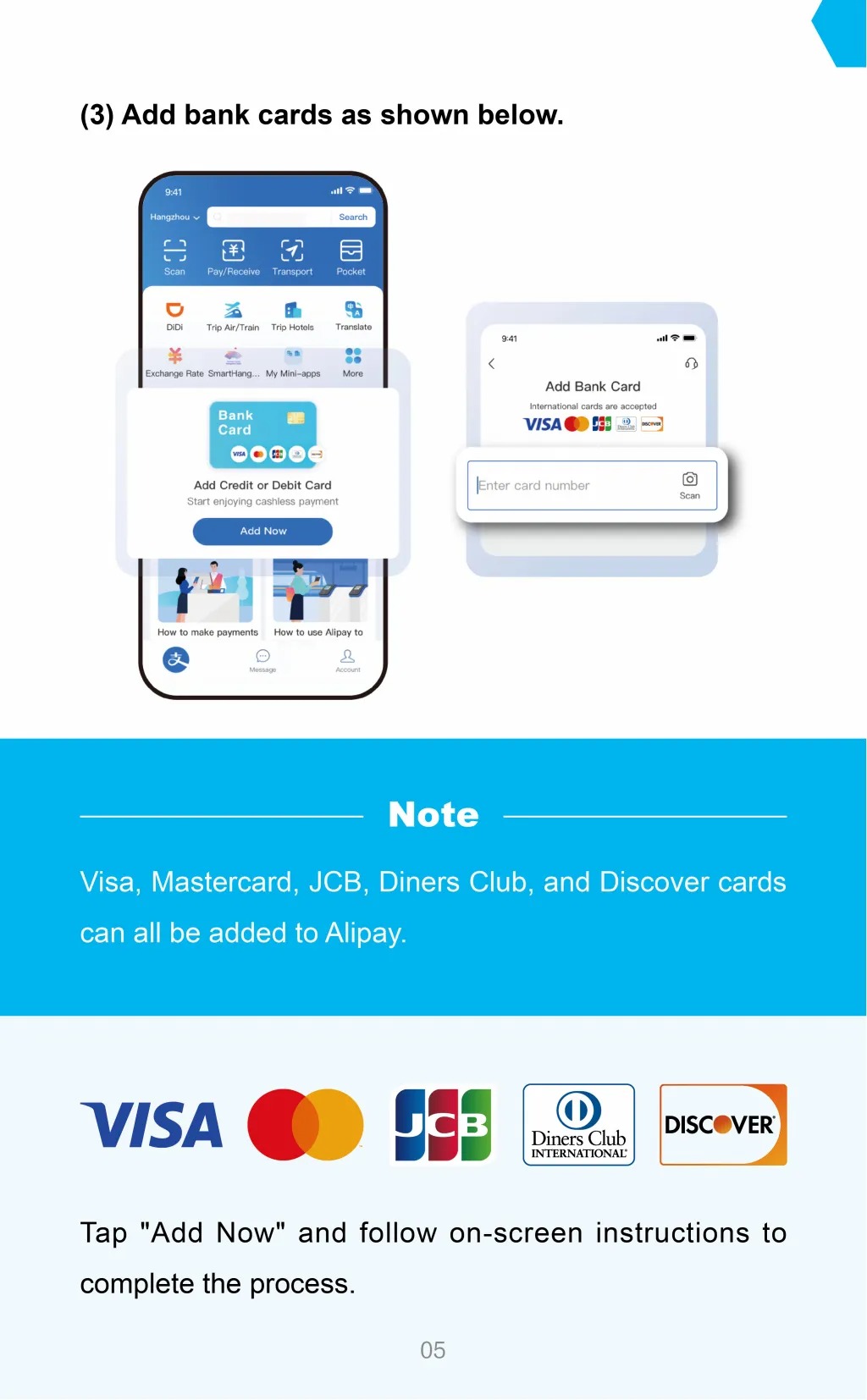

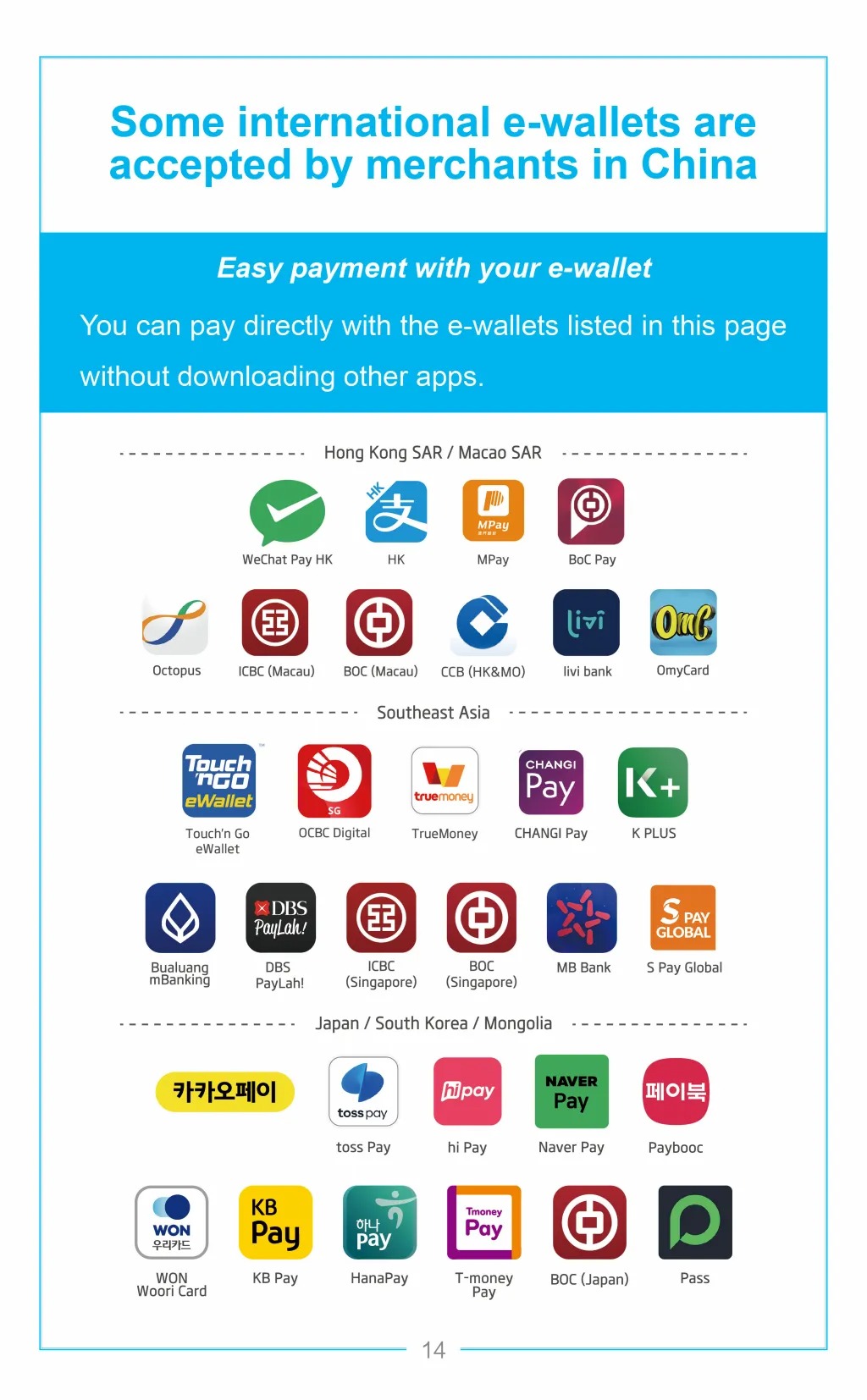

Mobile payment is a very common payment method in China, and the PBOC's guide has a simple introduction for this.

The guide points out that in China, just a mobile phone is enough for convenient payment services. There are multiple ways to choose, such as Alipay, WeChat Payment, Union Pay, etc.

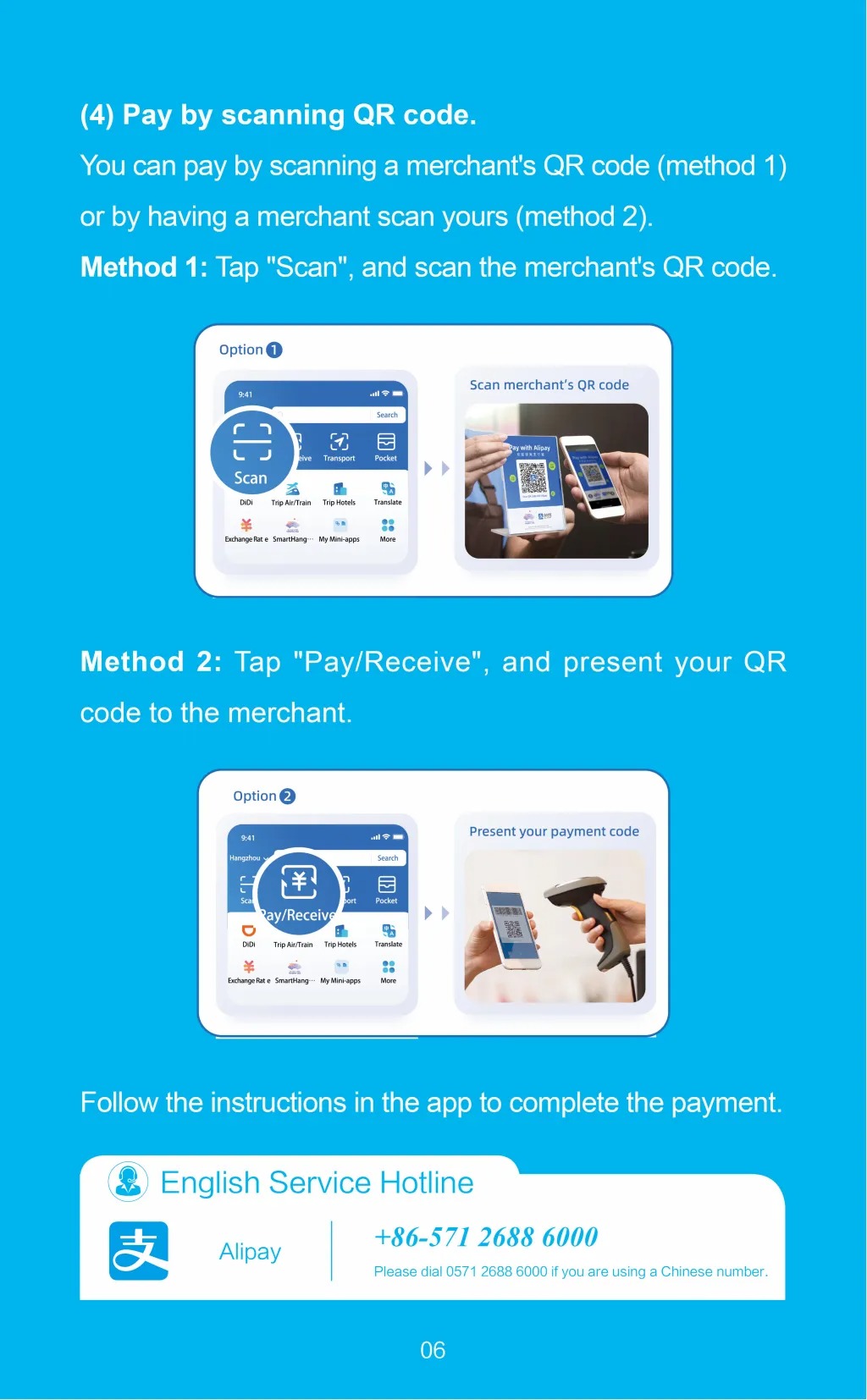

However, one thing should be noted that when using phones to scan the QR code for mobile payment, you need to pay attention to different mobile payment logos.

For example, when using the Alipay app to scan the QR code, you need to find the right code with the Alipay logo.

The guide also states that to facilitate foreigners to use mobile payments better, transactions below a certain amount do not require personal data registration.

As for cash, the guide indicates that cash CNY can be used for payment in China.

If you need cash CNY, you can withdraw it from ATMs with logos of the corresponding bank card organisations, or you can directly exchange at banks outlets with currency exchange signs, outlets of qualified financial institutions, or self-service kiosks.

If you want to open a local and foreign currency bank account in China, you can go to the nearest bank with valid documents such as a passport.

Commercial banks such as the Industrial and Commercial Bank of China (ICBC), the Agricultural Bank of China (ABC), the Bank of China (BOC), the China Construction Bank (CCB), and the Bank of Communications (BOCOM) can all provide this service.

After opening a bank account in China, foreigners can enjoy services such as deposit and withdraw of both CNY and foreign currencies, foreign currency purchase and sale, domestic transfer and cross-border remittance, foreign currency exchange and making payment.

The guide also mentions that foreigners who are interested in e-CNY can also use it for payment. Currently, the e-CNY App can be used in many pilot areas in Mainland China, covering Beijing, Shanghai, Tianjin, Guangdong, Sichuan, and other provinces and cities.

15 more countries given visa-free access to China

In fact, in order to restore and accelerate the personnel exchange, trade and tourism development post-Covid, China has successively granted unilateral visa-free entry policy to 15 countries in recent years, continuously expanding the visa-free "circle of friends".

The latest list includes Singapore, Brunei, France, Germany, Italy, the Netherlands, Spain, Malaysia, Thailand, Ireland, Switzerland, Hungary, Austria, Belgium, Luxembourg.

Singapore, Thailand, Malaysia, and Brunei have also reached mutual visa exemption agreements with China.

Statistics show that as of early March, China has signed mutual visa exemption agreements with 157 countries and has reached simplified visa procedures agreement or arrangements with 44 countries.

Read more: Overview of Octopus' 3 major cross-border payment services