Published : 2025-10-17

On October 17, 1983, the Linked Exchange Rate System was officially implemented in Hong Kong.

Hong Kong’s Linked Exchange Rate System is a Currency Board system. The Monetary Base is fully backed by U.S. dollar assets, and all changes in the Monetary Base are fully matched by corresponding changes in U.S. dollar assets held in the Exchange Fund at a fixed exchange rate.

The stability of the Hong Kong dollar exchange rate is maintained through an automatic interest rate adjustment mechanism and the firm commitment by the Hong Kong Monetary Authority (HKMA) to honour the Convertibility Undertakings (CUs).

The HKMA provides CUs, under which the HKMA commits to sell Hong Kong dollars upon request by banks at the strong-side CU of HK$7.75 per U.S. dollar, and to buy Hong Kong dollars upon request by banks at the weak-side CU of HK$7.85 per U.S. dollar.

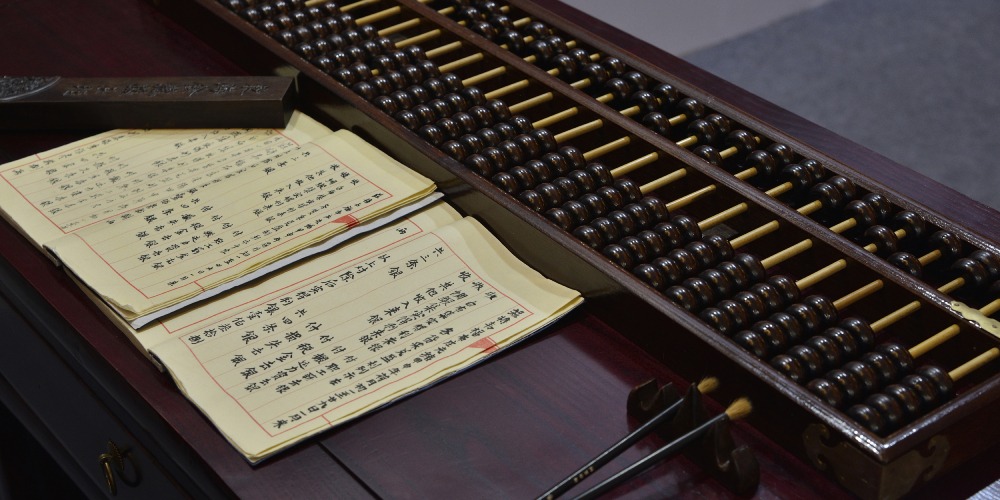

In history, Hong Kong has implemented different types of exchange rate systems.

From 1863 to November 4, 1935, Hong Kong used the international currency "silver dollar" as the legal tender and adopted the silver standard.

However, following the global silver crisis, Hong Kong abandoned the silver standard and pegged the Hong Kong dollar to pound sterling. The initial and middle period exchange rate was 16 Hong Kong dollars to 1 pound, and later it became 14.55 Hong Kong dollars to 1 pound.

In June of 1972, as United Kingdom allowed the pound to float freely, so Hong Kong switched to pegging its currency to U.S. dollar.

Initially, the exchange rate was 5.65 Hong Kong dollars to 1 U.S. dollar, then revised to 5.085 Hong Kong dollars to 1 U.S. dollar in February of the following year. By November of 1974, due to a weak U.S. dollar, the Hong Kong dollar became free-floating.

For the first two years of floating exchange rate, it operated quite smoothly. However, subsequent influences from currency, credit, and inflation led to instability in Hong Kong's economy at the time.

The GDP growth rate in 1975 dropped to 0.3%, but it soared to 16.2% in 1976. Inflation surged from 2.7% in 1975 to 15.5% in 1980.

Furthermore, on the one hand, there were speculative attacks.

On the other hand, there was a crisis of confidence in Hong Kong's future. Under the "pincer attack" of the two, the devaluation of the Hong Kong dollar reached a very serious point in 1983, with the exchange rate dropping drastically from 5.13 Hong Kong dollars to 1 U.S. dollar in 1981 to 9.60 Hong Kong dollars to 1 U.S. dollar in 1983.

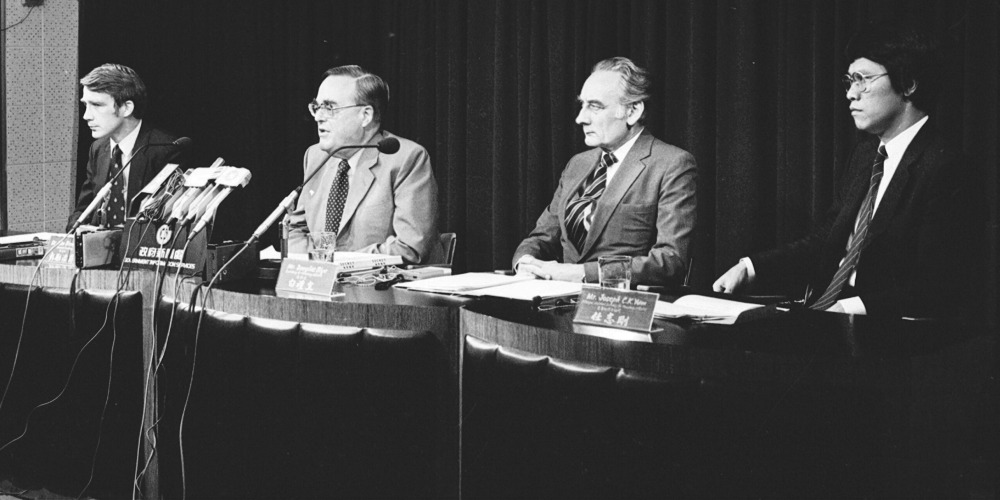

In the end, Hong Kong reverted to a fixed exchange rate again. On Saturday, October 15, 1983, then Financial Secretary John Bremridge announced the details of the Linked Exchange Rate System to the public and decided to formally implement it on Monday, October 17 of the same month.